DRAFT last updated 6/27/25

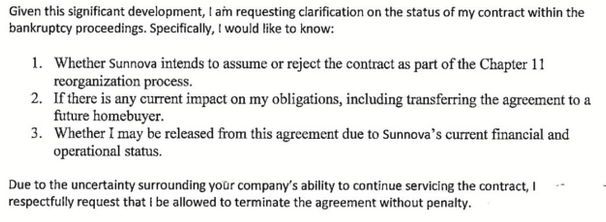

Our first Sunnova customer letter filed with the bankruptcy court. #

Marvin is asking excellent questions!

I sent Marvin an email, hoping he has more info and maybe he can help with objecting to the sale until the Sunnova customers’ interests and claims have been properly addressed and protected.

My initial research #

Ch. 11 and existing contracts.

The Ch. 11 purpose is to reorganize operations while negotiating and settling obligations. Sunnova stated in its Ch. 11 Notices to its customers:

… Sunnova intends to continue operating its business in the ordinary course throughout the sale process, with a goal of securing a long-term solution for the Company’s business operations under new ownership. Importantly, at this time, the Company is continuing to monitor, manage, and service existing in-service solar and battery storage systems as usual. …

Unfortunately, “as usual” is BAD news for my client and many other Sunnova customers. “As usual” means that systems are NOT repaired, are consistently under-producing, and the damages can be THOUSANDS of dollars for much higher utility costs than the Sunnova credits for underproduction. Not to mention the stress and frustration and the time wasted by Sunnova’s horrific communications and customer service.

Here is an article on executory contracts:

https://www.abc-amega.com/articles/executory-contracts-in-chapter-7-and-11-bankruptcies/

… The Bankruptcy Code does not specifically define the executory contract. However, most bankruptcy courts have adopted the following definition:

A contract under which the obligation of both the bankrupt and the other party to a contract are so far unperformed that the failure of either to complete performance would constitute a material breach excusing the performance of the other. …

What does THAT mean for Sunnova customers with system performance issues and Sunnova’s failures to repair and compensate?

More information in this article:

Keep in mind that the “customer” referred to is the party in bankruptcy, Sunnova.

I have not yet found information on CONSUMER contracts.

Mortgages are routinely sold (assigned). However, these solar contracts are different because they contain warranties and guarantees that the Sunnova purchaser should honor.

Sadly, it appears that even Sunnova does not know what the contractual guarantees mean and how to calculate credits, as we have NOT received an answer to our question and I will address this issue in our Claim.

COMPETENT ATTORNEYS should represent the thousands of Sunnova customers with system problems to ensure that they are properly compensated. #

- The customers and the purchaser of these contracts need to know how to calculate credits under the various guarantees.

- Thousands of customers deserve COMPENSATION for underproduction and subsequent higher utility bills.

- My client’s Sunnova Lease was “ADAPTED FROM THE ACEC SOLAR LEASE AGREEMENT” — some parts make no sense!

Other solar companies have filed for bankruptcy and “somebody” should research those cases.

I’m afraid that the court / trustee will IGNORE the customers’ claims.

From https://bondoro.com/sunnova/

.. In April 2021, Sunnova acquired SunStreet, the residential solar development arm of homebuilder Lennar Corporation, becoming Lennar’s exclusive solar and storage provider for new home communities nationwide. …

Sunnova sued a SunStreet customer over $260 in delinquent payments. #

According to the customer, Sunnova had shut off the system in 12/23, her account access was shut off and she could not make payments anymore. Sunnova REFUSED her calls, would not let her bring the account current and referred her to the outside collection lawyers.

Sunnova’s attorneys REFUSED to accept the payment to bring the loan current prior to suing the customer, demanding the full amount due for the entire lease, almost $20,000!

Apparently, this is how Sunnova attempted to raise cash for its operations in 2024. UNREAL!

Sunnova’s California collection attorneys should be disbarred.